Unemployment Compensation Payments to Individuals Vary According to

However there are calculators you can use to estimate your benefits. As with regular unemployment compensation benefit amounts vary by state and are calculated based on weekly benefit amounts.

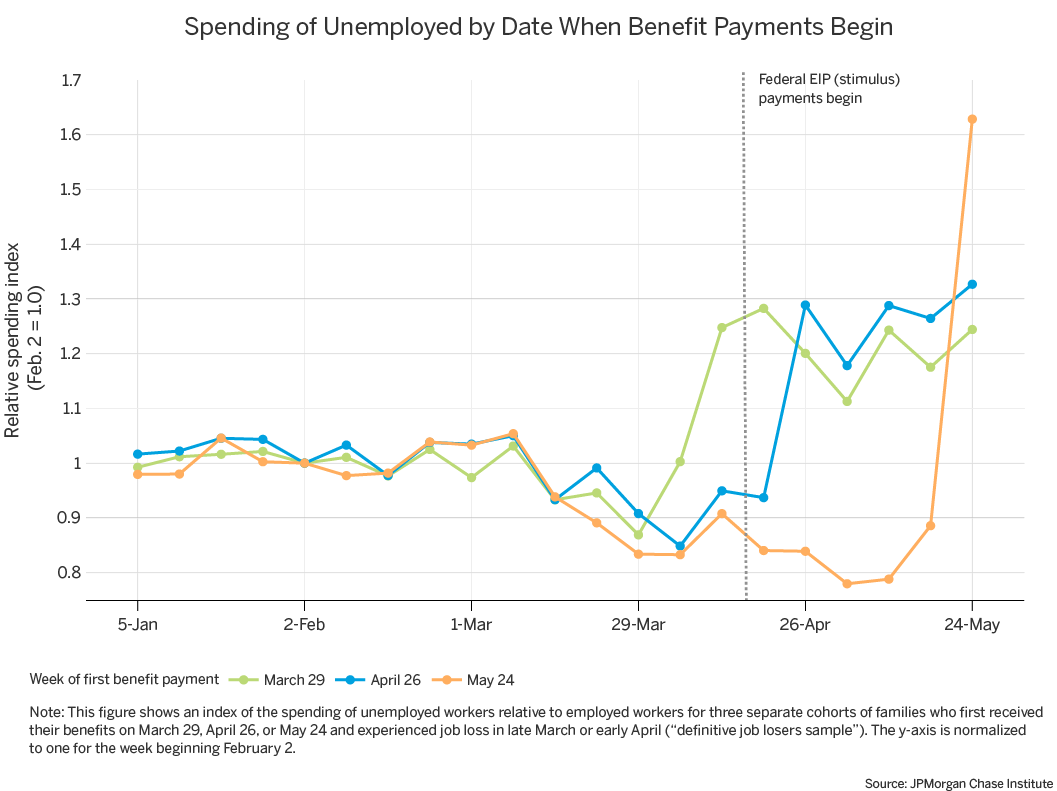

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Unemployment compensation payments to individuals vary according to a.

. Unemployment compensation is a benefit paid to people who have recently lost their job via no fault of their own such as being laid off or if the business closed. The Federal Pandemic Unemployment Compensation FPUC is an emergency program intended to help relieve those affected by the COVID-19 pandemic. The type of job held before layoff.

Job type and length of previous employment. Department of Labor there are two main criteria that must be met in order to qualify. Their previous wage rate and length of previous employment.

Each January we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. 13 Weeks of Emergency Unemployment Compensation Available in All States for Workers who Exhaust Regular Benefits. Unemployment compensation for United States workers was first established in the federal Social Security Act of 1935 in response to the Great Depression of the 1930s.

Individual pay rates will of course vary depending on the job department location as well as the individual skills and education of each employee. Unemployment benefits are received through a joint state-federal program that provides compensation to eligible workers who are unemployed through no fault of their own. Unemployment compensation payments to individuals vary according to the type of job held off before layoff the qualify for old age benefits a person must reach retirement age and have earned.

Individual Unemployability is a part of VAs disability compensation program that allows VA to pay certain Veterans disability compensation at the 100 rate even though VA has not rated their service-connected disabilities at the total level. Information Needed For Your Federal Income Tax Return. Each state has a different rate and benefits vary based on your.

The type of job held before layoff. -Unemployment compensation payments to individuals vary according to their previous wage rates and length of previous employment -workers compensation payments are typically based on. Eligibility requirements to qualify for unemployment compensation vary from state to state.

State UI laws provide for the payment of partial weekly amounts when individuals are employed less than full-time during a week. While some states simply provide the same number of weeks of benefits to all unemployed workers most states vary the number of weeks according to the amount of a workers past earnings whether the worker had earnings in each of the four calendar quarters that make up the base period and how evenly those earnings were distributed over the base period. Unemployment compensation payments to individuals vary according to.

Unemployment benefits are often. Expanded Eligibility for Unemployment Benefits to Fill Coverage Gaps. Their previous wage rate and length of previous employment.

Va Individual Unemployability Benefits. Their previous wage rate and the type of job held before layoff. Federal income tax is withheld from unemployment benefits at a flat rate of 10.

You can use IRS Form W-4V to have taxes withheld from your benefits. Unfortunately theres no easy way to calculate exactly how much money youll receive through unemployment benefits or for how long youll be able to collect those benefits unless your state has an online unemployment calculator. However according to the US.

You must be unemployed through no fault of your own. Federal pandemic unemployment compensation. Job type and length of previous employment.

It provides a flat additional compensation to. All states would be eligible to provide an additional 13 weeks of unemployment benefits to workers who need beyond what is provided for in state and federal law. State UI laws vary as to the number of hours andor days individuals must be in non-employment status during a week in order to be eligible for a partial payment of UCFE.

See Page 1. Unemployment Compensation pays an average hourly rate of 141 and hourly wages range from a low of 124 to a high of 161. In most cases individuals.

The benefits received by qualified individuals are funded by payments made by employers and collected at. The new law creates the Federal Pandemic Unemployment Compensation program FPUC which provides an additional 600 per week to individuals who are collecting regular UC including Unemployment Compensation for Federal Employees UCFE and Unemployment Compensation for Ex-Servicemembers UCX PEUC PUA Extended Benefits EB Short Time. So if you receive unemployment compensation in 2021 or beyond expect to pay federal tax on the amount you get.

Social Protection Statistics Unemployment Benefits Statistics Explained

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

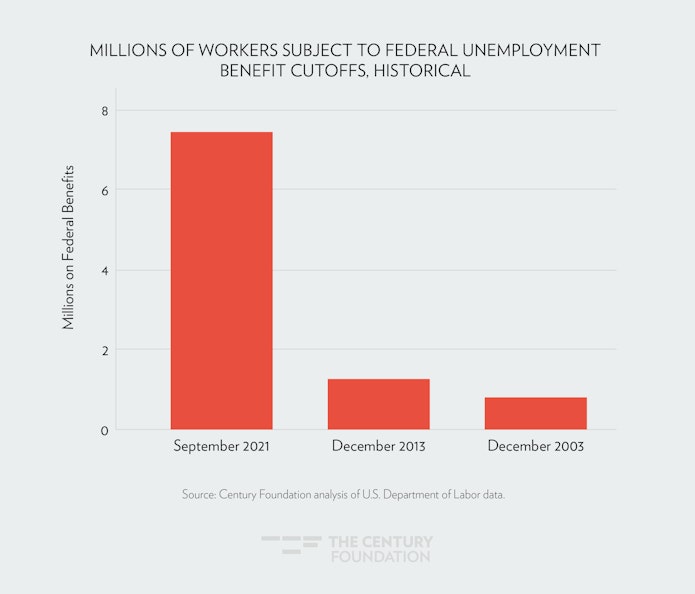

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

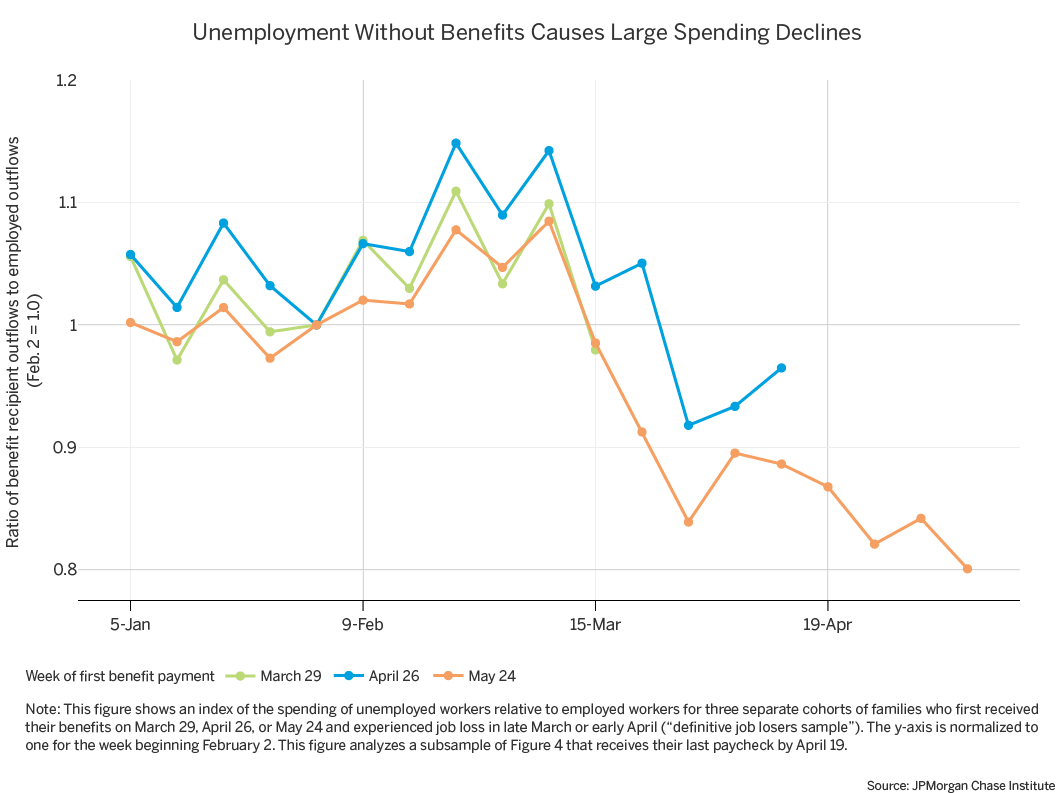

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

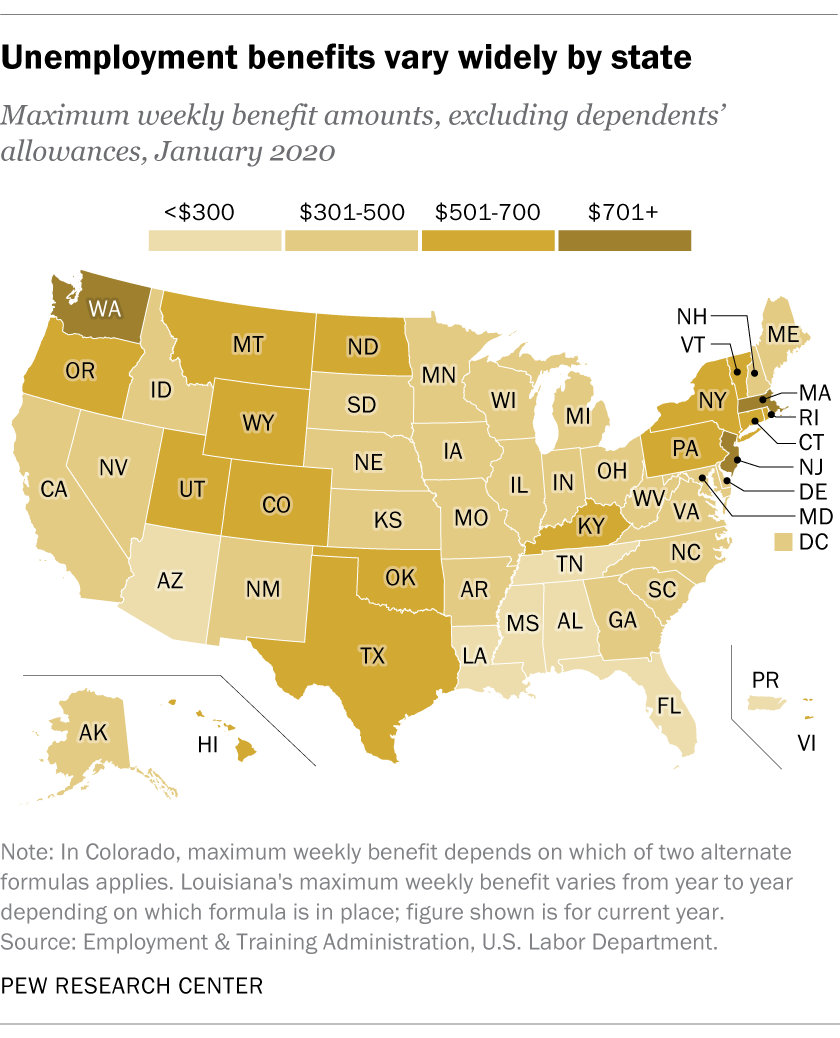

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Social Protection Statistics Unemployment Benefits Statistics Explained

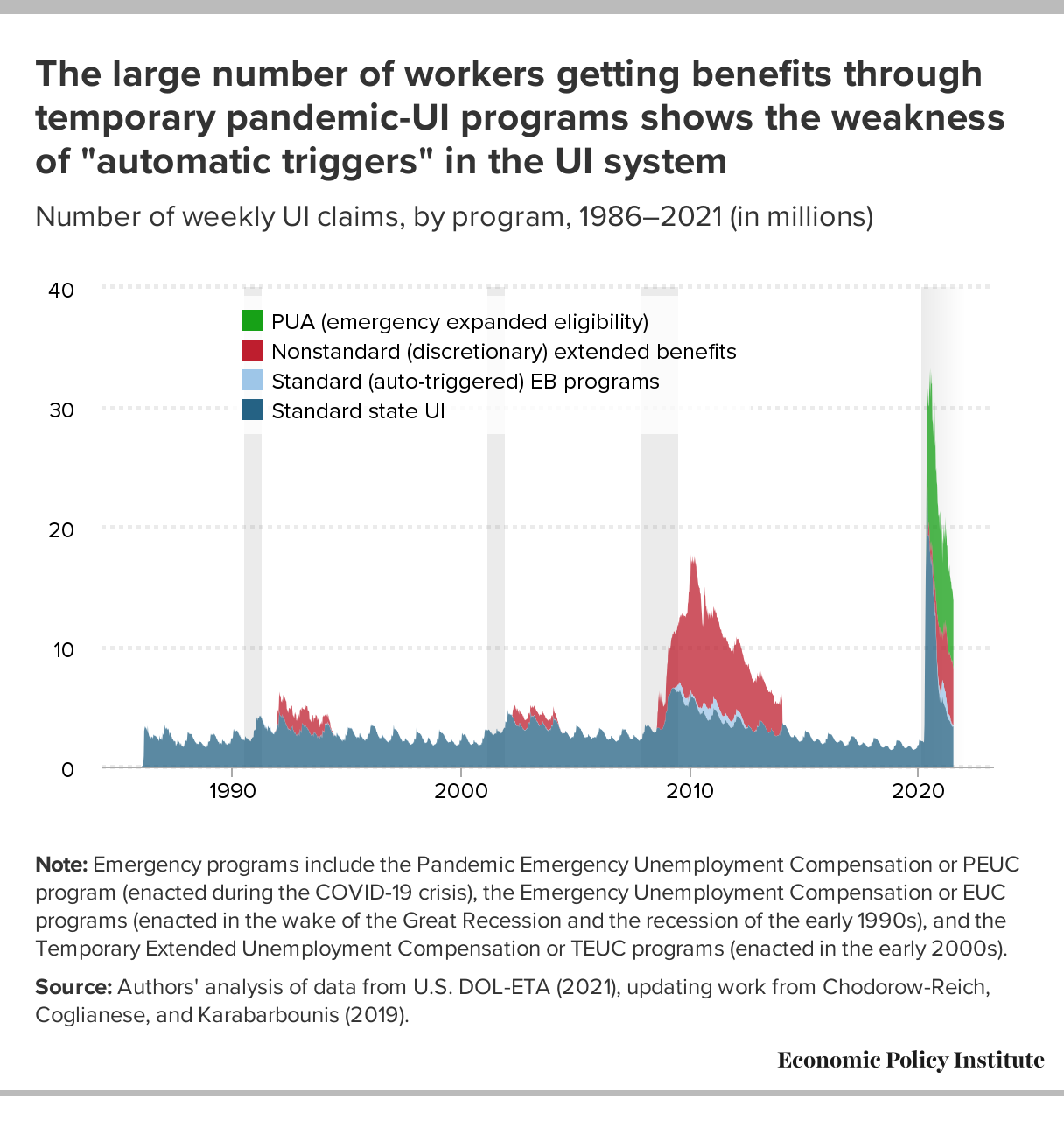

How To Boost Unemployment Insurance As A Macroeconomic Stabilizer Lessons From The 2020 Pandemic Programs Economic Policy Institute

Social Protection Statistics Unemployment Benefits Statistics Explained

Social Protection Statistics Unemployment Benefits Statistics Explained

Workers Are A Year Into Unemployment Benefits It S Causing Problems

Social Protection Statistics Unemployment Benefits Statistics Explained

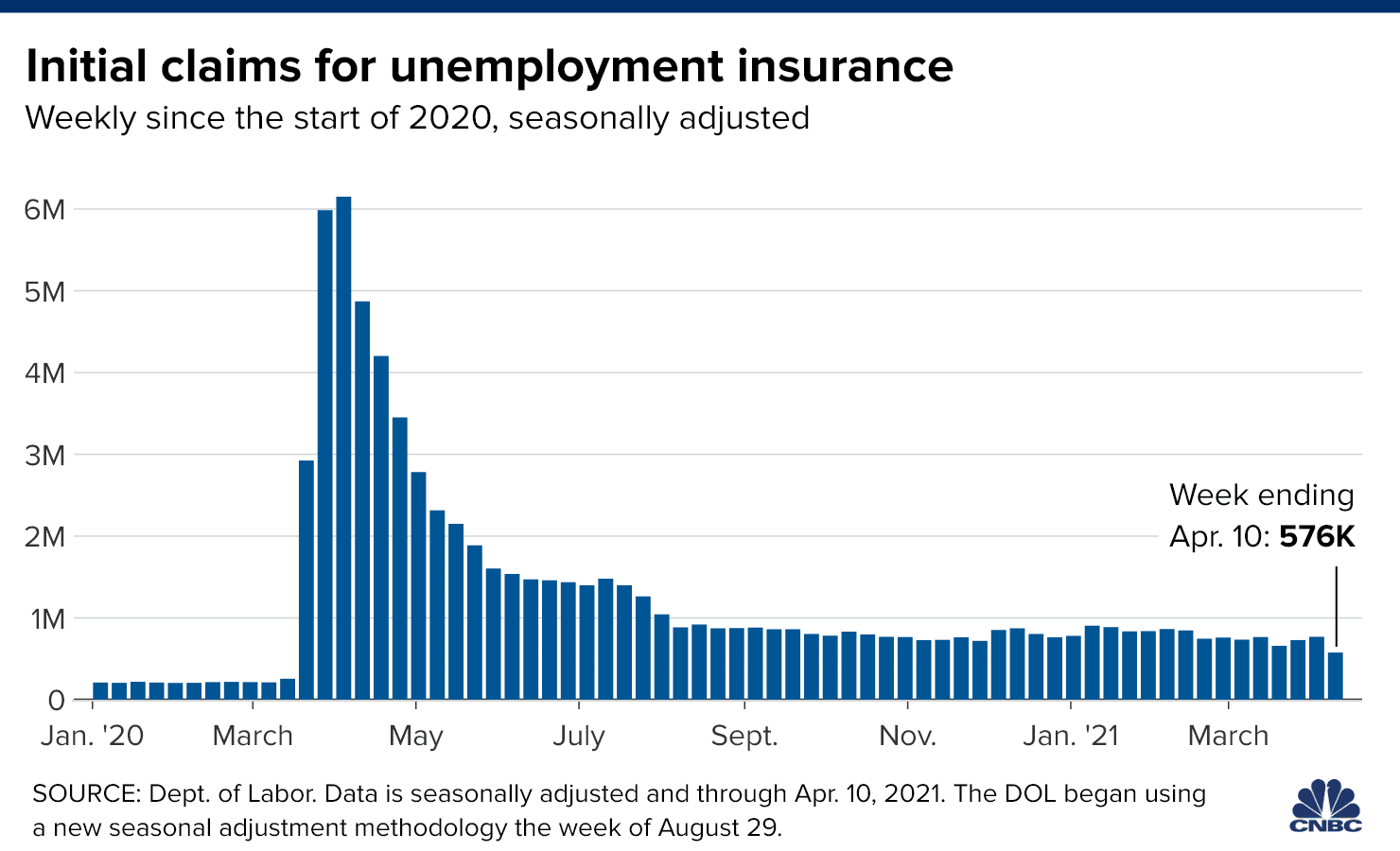

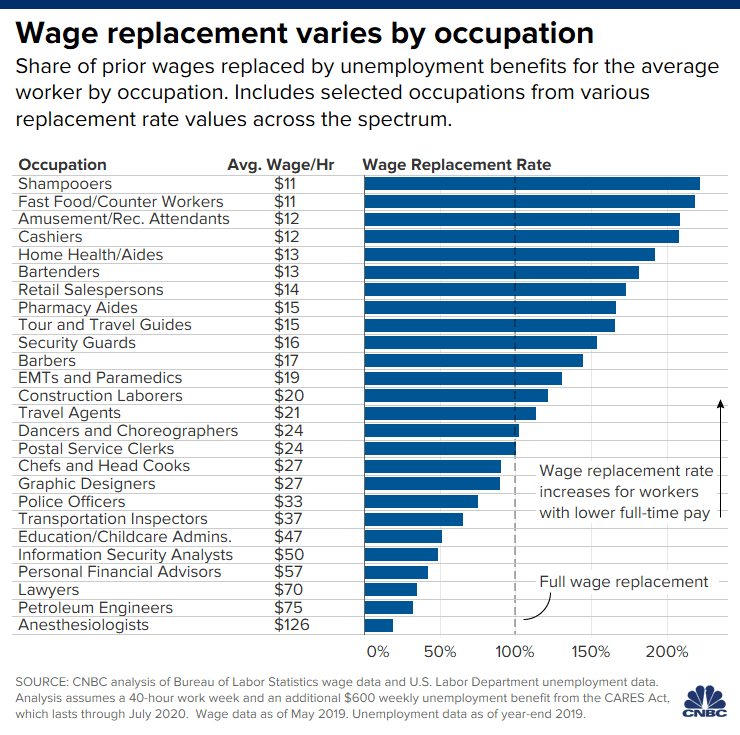

It Pays To Stay Unemployed That Might Be A Good Thing

Social Protection Statistics Unemployment Benefits Statistics Explained

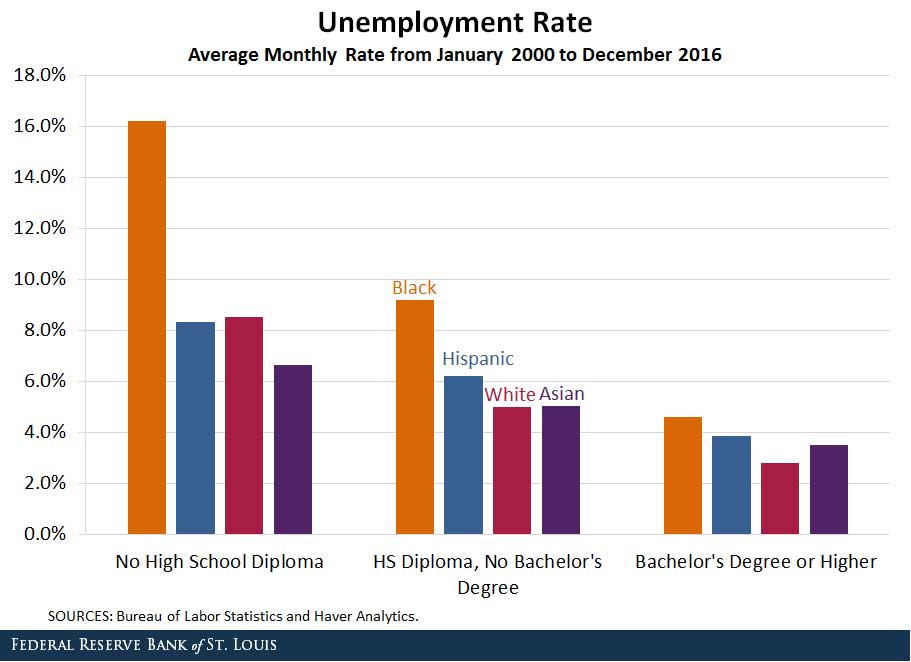

Why Do Unemployment Rates Vary By Race And Ethnicity

Social Protection Statistics Unemployment Benefits Statistics Explained

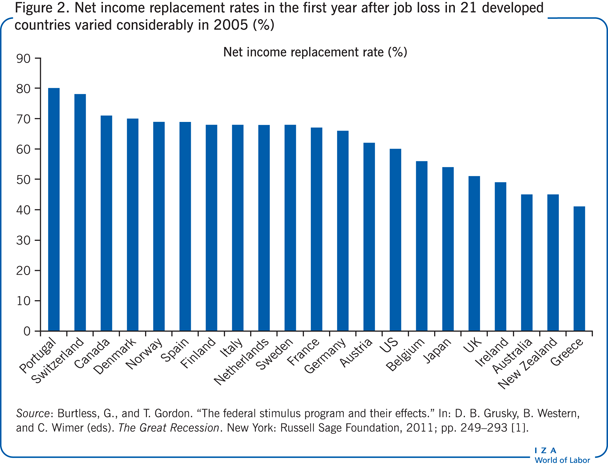

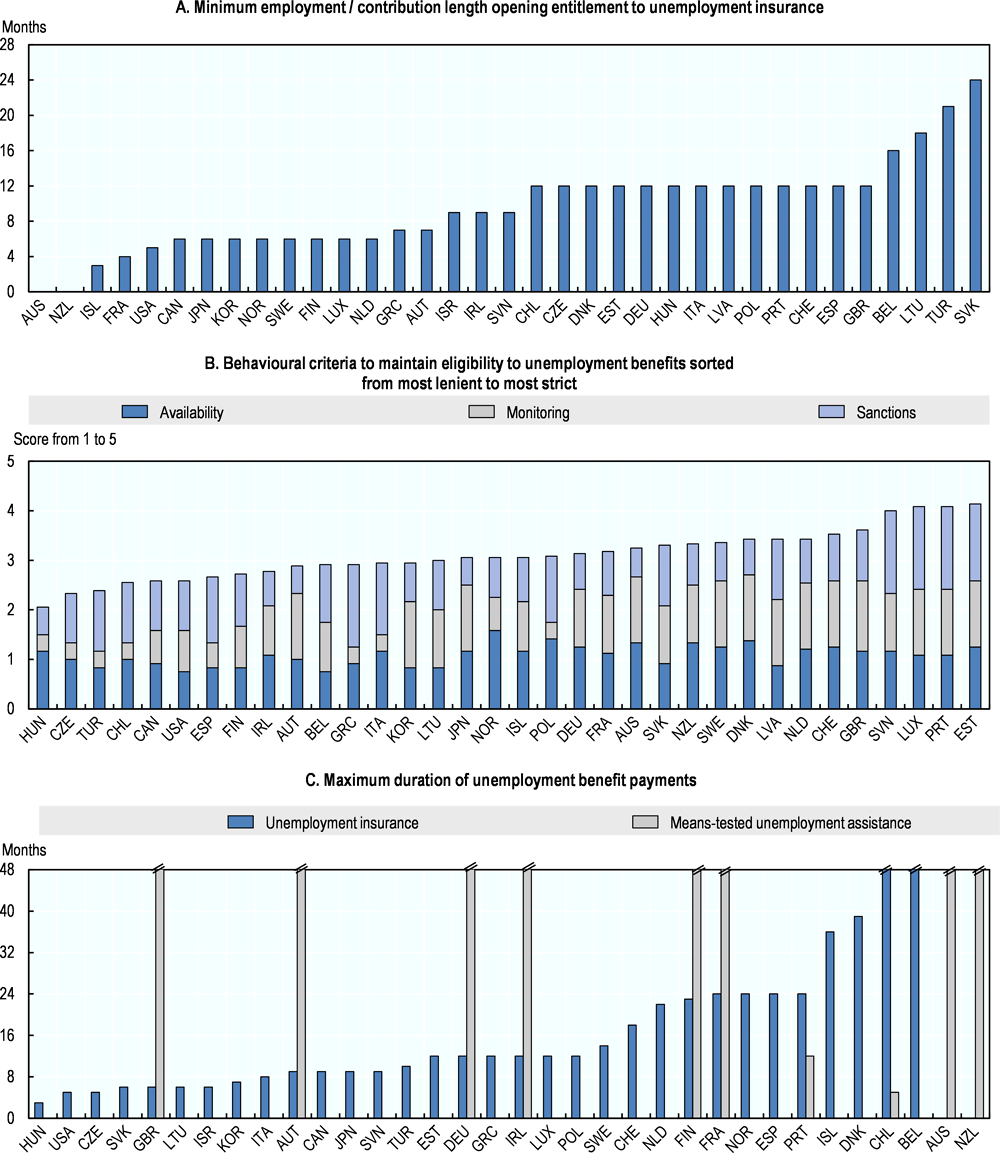

Iza World Of Labor Unemployment Benefits And Unemployment

So Far Ending Pandemic Unemployment Aid Has Not Yielded Extra Jobs The Economist

Comments

Post a Comment